Central Provident Fund Board

Retirement savings to meet your basic living expenses in old age

CPF Overview

| What is CPF? The Central Provident Fund (CPF) is a comprehensive social security system that enables working Singapore Citizens and Permanent Residents to set aside funds for retirement. It also addresses healthcare, home ownership, family protection and asset enhancement. |

Retirement Sum Scheme |

||||||||||||||||||||||||||||||||

|

The Retirement Sum Scheme provides CPF members a monthly income to support a basic standard of living during retirement. What is the Retirement Sum Scheme?The Retirement Sum Scheme provides CPF members a monthly income to support a basic standard of living during retirement. To better mitigate longevity risks, the CPF LIFE Scheme introduced in 2009 provides a monthly income for as long as you live. You will join CPF LIFE if you are a Singapore Citizen or Permanent Resident born in 1958 or after, and have the following Retirement Account balances:

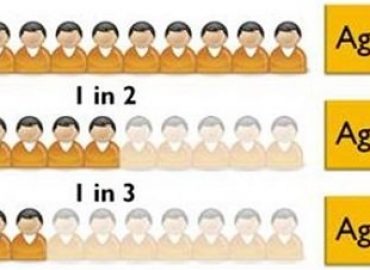

If you are not placed on CPF LIFE, you can apply to join anytime between your payout eligibility age and before you turn 80 years old or remain on the Retirement Sum Scheme. What is a retirement sum?This is the amount of retirement savings which you have chosen to set aside in your Retirement Account to receive monthly payouts from your payout eligibility age, which is currently at age 65. Your retirement sum can be used to join CPF LIFE which provides you with life-long monthly payout or the Retirement Sum Scheme which provides you with a monthly payout until your Retirement Account balance is depleted. How much is the retirement sum?At age 55 and after, you can choose your desired future monthly payout to meet your retirement needs. The more you set aside in your Retirement Account (RA), the higher your future monthly payout. Please click on Retirement Payouts (PDF, 0.4MB) to see how the RA savings you set aside at age 55 affect your future monthly payout. To help you plan early for retirement, the Basic Retirement Sum (BRS) will be made known to you ahead of time. For each successive cohort of members turning age 55, the payouts need to be higher to account for long-term inflation and improvements in standard of living. Hence, the BRS has to be adjusted. The Full Retirement Sum (FRS) is set at two times the BRS, while the Enhanced Retirement Sum (ERS) is set at three times the BRS. The Retirement Sums for members turning age 55 up to year 2022 are as follows:

|

How is the retirement sum set aside?

When you reach 55 years old, your Special and/or Ordinary Accounts savings will be transferred to your Retirement Account (RA), up to the Full Retirement Sum (FRS).

You can choose to set aside a larger retirement sum, up to the Enhanced Retirement Sum, by topping up your RA using cash or transferring your remaining CPF savings in the Special and/or Ordinary Accounts via the Retirement Sum Topping-Up Scheme (RSTU).

After setting aside the FRS fully with cash, or with cash (i.e. at least the Basic Retirement Sum) and property, you can choose to withdraw the remaining cash balances in your Ordinary and Special Accounts, or continue to keep your savings in CPF to earn attractive interest.

Why do I need to set aside a retirement sum?

Setting aside a retirement sum when you reach 55 years old ensures that you have a regular income from your payout eligibility age:

| Year of Birth | Payout Eligibility Age |

| 1943 and before | 60 |

| 1944 to 1949 | 62 |

| 1950 and 1951 | 63 |

| 1952 and 1953 | 64 |

| 1954 and after | 65 |

Can I be exempted from setting aside a retirement sum??

If you are aged 55 and above and are receiving lifelong monthly payouts from a private annuity (bought using cash or under the CPF Investment Scheme) or a pension, you may apply to be exempted from setting aside a retirement sum in your Retirement Account.

You may be fully or partially exempted, depending on the lifelong monthly payout amount from your annuity or pension.

Courtesy posting by NextLifeBook.com